Scams: Tax Season Underway

Scams

February 23, 2023

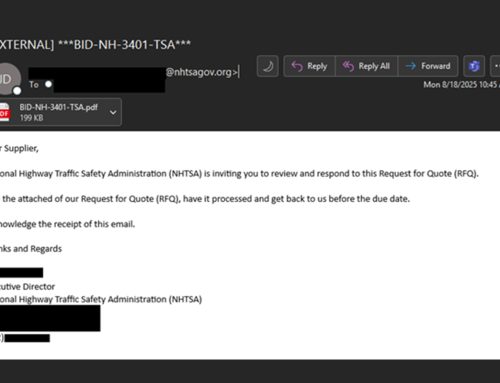

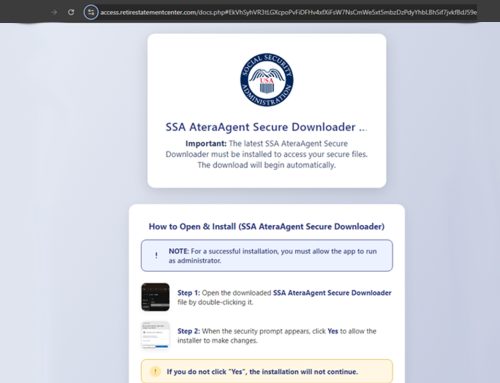

Cybercriminals often take advantage of specific times of the year, and with tax season underway, threat actors are quick to launch social engineering campaigns conducted via email, phone, and SMS text messages. These social engineering attempts may impersonate legitimate tax services or the Internal Revenue Service (IRS) to trick recipients into disclosing sensitive information or credentials. In fact, many tax preparation offices have been targeted by cybercriminals in attempts to compromise networks and retrieve employee and customer information.

Threat actors often seek out tax information, including W-2 information and personally identifiable information (PII) – such as Social Security numbers (SSNs), dates of birth, bank account or credit card numbers, and drivers’ license numbers. With this information, threat actors can file fraudulent tax returns to collect refund money and engage in other identity theft schemes.

The NJCCIC advises against paying ransoms of any kind, as these scams are typically not considered credible threats unless photos or videos are provided. Users are advised to inspect questionable requests for typical indicators of these scams, exercise caution with unsolicited communications, and refrain from providing photos or videos, personally identifiable information (PII), financial information, or funds.

Incidents can be reported on https://www.cyber.nj.gov/report (the NJCCIC Cyber Incident Report Form) and https://www.ic3.gov (the FBI’s Internet Crime Complaint Center).

For any further questions, please contact us at Cyber Command.