Uptick in Investment Schemes

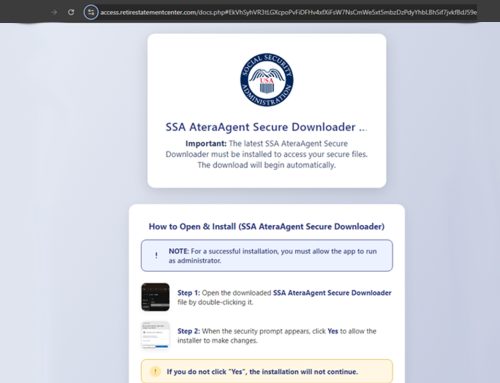

Over the past several weeks, the NJCCIC observed an uptick in investment schemes, resulting in losses between $900 and $1.8 million. Threat actors pose as experienced investment advisors or registered professionals as part of an investment group. They send unsolicited requests, invite potential victims to private or group chats, provide general market advice, direct trades, and promise high-yield, quick-return investments. Threat actors employ high-pressure tactics, use stolen branding or images, and create deceptive deepfake videos to promote their online AI trading scams through social media, video platforms, and low-quality blogs. They also generate fraudulent websites or platforms, fake reviews, and misleading advertisements. For example, threat actors impersonated a legitimate company and created a fraudulent website with stolen branding to lure potential victims to sign up and invest funds.

Threat actors also impersonate prominent public figures to endorse fraudulent investment schemes, such as claiming to give away free cryptocurrency if targets invest in specific organizations like Elon Musk and Tesla. Cryptocurrency scams , especially pig butchering schemes, remain prevalent. Threat actors initially lure targets through dating apps, job postings, and social media platforms, building trust with their targets before attempting to defraud them. After the targets deposit funds on the fraudulent platforms, they cannot withdraw their “investments.”

Recommendations

- Do your research on any investment and look for reputable sources. Check for reviews and performance history.

- Never invest more than you can afford to lose.

- Avoid clicking links, opening attachments, responding to, or acting on unsolicited communications.

- Independently verify unsolicited offers and do not release any personally identifying information, financial details, or funds until you have confirmed the legitimacy of the offer.

- Keep systems and apps up to date.

- Report these scams and malicious cyber activity to the NJCCIC, the FBI’s IC3, and the FTC.

- If victimized, monitor bank accounts, credit profiles, and other online accounts for any irregularities or suspicious behavior.

- Review the Identity Theft and Compromised PII NJCCIC Informational Report for additional recommendations and resources, including credit freezes and enabling MFA on accounts.